Report Summary

Period covered: 30 November - 03 January 2026

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30-day membership trial now.

Retail Sales Performance

Retail sales growth rose xx% year-on-year in December according to the Retail Economics Retail Sales Index, compared to a three-month average of xx%.

Factors impacting the headline performance in the month include:

-

Dampened mood: Many consumers remained price sensitive and waited for discounts, leaving retailers hoping that a strong final Christmas week and post Christmas clearance would make up for earlier weakness. However, while footfall ticked up in the last week of the month leading to a xx increase overall, it was not enough to make up for a tepid month.

-

Credit reliance: UK consumers increasingly leaned on credit to fuel their festive spending. Consumer credit growth accelerated xx% YoY in November, with credit card balances up over xx% YoY, the fastest rise since January 2024. Households borrowed a net GBP xx in consumer credit during November alone, of which GBP xx was on credit cards, suggesting many families financed Christmas purchases through debt.

-

Shift towards experiences: There were signs of consumers putting discretionary income towards leisure and experiences at the expense of non essential retail, with pub and travel agent sales growing modestly.

-

Divided performance: While many retailers struggled, some outperformed. Next, for instance, announced a sales increase of xx% YoY for the nine weeks to 27 December. Across non food categories, those with strong value or online and multichannel propositions outperformed.

Category impact

-

The sluggish approach to Christmas led retailers to discount heavily, hoping for a last minute rush of shoppers at the end of the month. But while footfall did increase in the second half, it did not translate into significantly higher sales.

-

Clothing sales rose by xx% YoY and footwear rose by xx%, with demand subdued by consumer caution and a shift of spend towards experiential spending. However, over the two months of November and December, clothing sales grew xx% and footwear by xx%, an uplift compared to 2024's falls of xx% and xx%.

-

Performance across clothing and footwear varied significantly by retailer. While many struggled, those with a strong value proposition and strong multichannel operations bucked the trend, including Next and Matalan. The results suggest that even as the category remains subdued, retailers with compelling offers could still achieve growth.

-

Health and beauty sales grew by xx% YoY, and xx% across November and December combined. The category remained a bright spot for the non food sector, as customers continued to spend on personal care, cosmetics and wellness products, aided by Christmas gifting and holiday season indulgences.

-

Home categories had a subdued month, as consumers shifted their focus towards gifting and food. Homewares (+xx%) held up slightly better as shoppers bought last minute decor. Furniture and flooring (-xx) had a quieter month as shoppers put larger purchases on the back burner.

-

DIY and gardening (-xx%) slipped into negative territory in December, with seasonal purchases and small home upgrades not doing enough to lift the category into positive territory in the final month of the year.

-

Electricals experienced a decline (-xx%) after a surge in sales over Black Friday. Across November and December combined, the category saw growth of xx%, driven by intense promotional activity.

-

Food sales rose xx%, with growth driven by continued food inflation. Sales reached a record GBP xx in the four weeks to 28 December, according to Kantar, with shoppers spending on festive items while also planning carefully and prioritising value. Promotions accounted for xx% of all spend, the highest since 2019, as brands relied on deals to defend volumes.

Macroeconomic backdrop

-

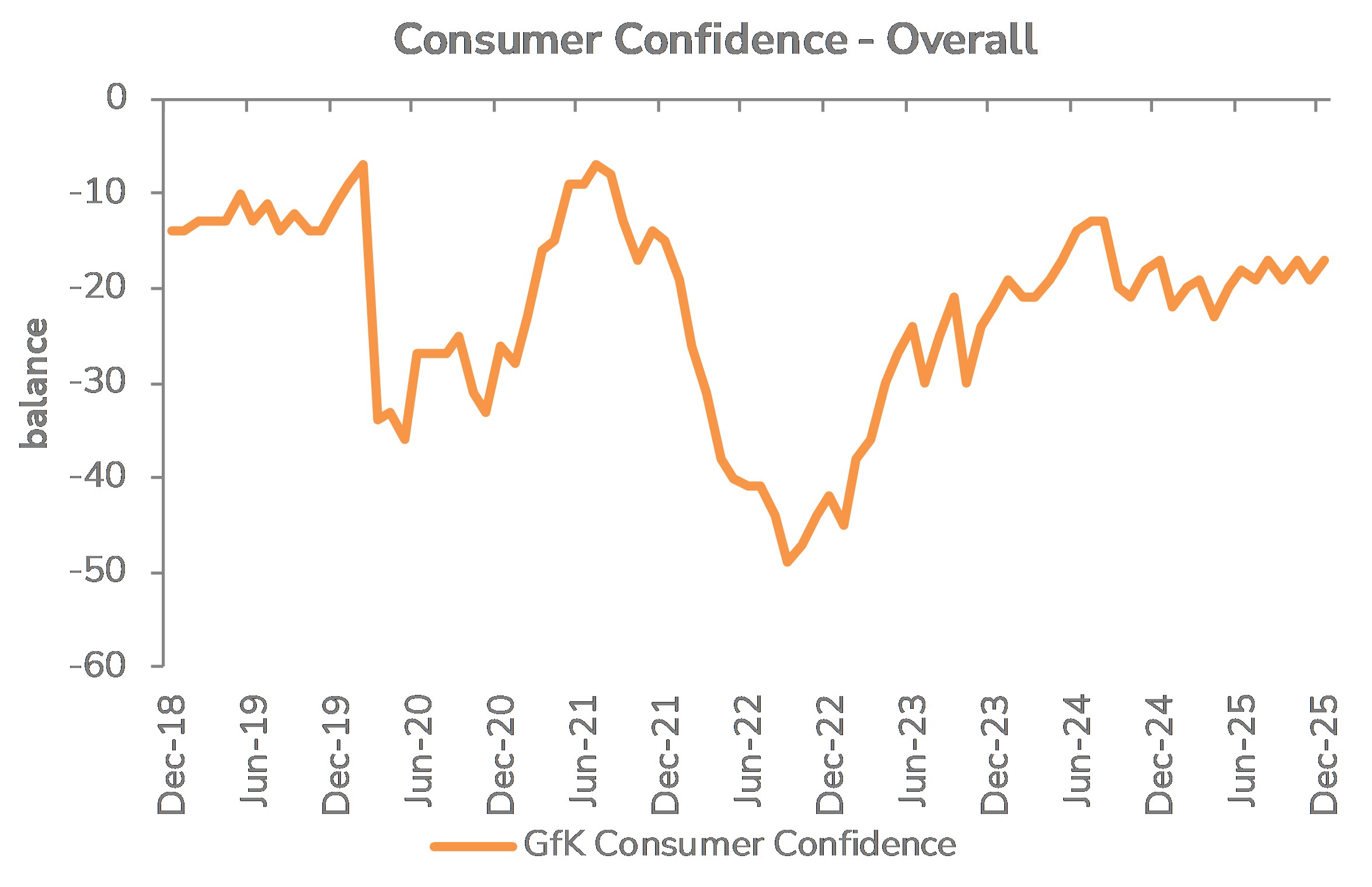

While the impact of the late November Budget has faded, leading to an uptick in confidence in December to xx points, wider economic uncertainty continued. Consumers felt more confident about their ability to manage their personal finances, but pessimism about the economy continued to dampen spending.

-

With inflation on a downward trajectory, albeit one that was interrupted after CPI increased to xx in December, the Bank of England cut interest rates to xx on 17 December.

-

Despite December's rise, the expected trend of inflation is downward. Investors expect further rate cuts in 2026, supporting a gradual recovery in retail spending.

-

UK GDP rose by xx in the three months to November 2025, an improvement on October's 0.1% contraction, although momentum remains weak. Compared with a year earlier, GDP was xxhigher, offering evidence of some underlying growth despite weak momentum.

-

The job market continued to soften, with unemployment hitting xx in the three months to November.

-

While pay growth continues to outpace inflation, supporting real incomes, the higher unemployment rate suggests weaker labour demand and more cautious hiring behaviour.

-

While job losses remain limited, rising job insecurity is likely to weigh on confidence and could impact spending in the months ahead.

Take out a FREE 30 day membership trial to read the full report.

Confidence rises in December

Source: Retail Economics analysis, GFK

Source: Retail Economics analysis, GFK